So·ci·us

(sō’-shē-ǔs) n. (Latin)

a partner, associate or ally

Socius Capital, LLC is an independent private equity sponsor that works with experienced middle market management teams to provide capital and lead transactions that ultimately result in those teams realizing their goals of owning a material equity position in their enterprise. We also provide growth capital to ownership groups, including acquisition financing.

LIQUIDITY/GENERATIONAL TRANSFERS

In December 2008, Socius Capital led a generational recapitalization of Wazee Companies, LLC, a Denver based provider of electrical motor maintenance and related services. The company had been family owned since it inception in the 1920’s…

MANAGEMENT LED BUYOUTS AND BUYINS

In March 2014, we backed the existing management team of Precision Machine and Manufacturing in the acquisition of the company from its retiring owner. Precision is a Eugene, Oregon based manufacturer of material handling equipment…

ACQUISITIONS/GROWTH FINANCINGS

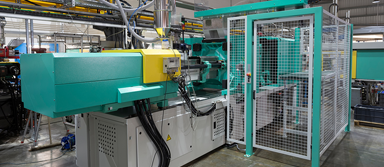

In December 2010, Socius provided junior capital to support the growth and acquisition objectives for Intertech Plastics and its sister company, Twist Body Brands. Intertech Plastics is a leading, Denver based plastics injection…

Our Team

Choosing a partner is one of the most important things one can do – in business and life. At Socius, we focus on being good listeners, meaningful contributors and supportive partners. We then bring significant industry and financial experience, along with extensive contacts and resources to help drive the growth of business value. Just as we would look forward to a long term relationship with our partners, Dave, Jeff and Steve have been friends and colleagues for many years, having met on the first day of classes in business school over 25 years ago.

DAVID WOODWARD

David is a co-founder and Managing Director of Socius Capital. He has spent the last 25+ years investing in smaller middle market companies in a senior management capacity. Dave began his direct investing career in 1987 as an investment manager and later as a General Partner of Amsterdam Pacific Corporation, a San Francisco based merchant bank. He later co-founded and served as General Partner of an affiliated entity, Pacific Mezzanine Fund. In 1999, he was recruited by GATX Capital to serve as the co-head of a recently formed Mezzanine Investment Group. Just prior to the formation of Socius Capital, Dave was a Managing Director with Vintage Capital, a structured debt and equity fund based in Los Angeles.

At Socius Capital, Dave served on the board of two portfolio companies that have now been fully exited, OTSP and Wazee Companies. He currently serves on the board of Precision Machine and Manufacturing, Inc. and Pioneer Recycling Services, LLC.

Prior to becoming involved in direct investing, he was a consultant with Bain and Company as well as having had a successful stint in sales for General Electric. At Bain and Company, he was part of a three-person team that relocated to Australia to establish operations in that country.

Dave graduated with a B.A. in Economics and Political Science from Yale University in 1978 and received his M.B.A. from Harvard Business School in 1984.

He currently divides his time between San Francisco and Ketchum, Idaho where he enjoys a number of outdoor pursuits including fishing, hiking, biking hunting and golf. He also serves as a board member, member of the executive committee and Treasurer of the Wood River Land Trust.

P. O. Box 7680

Ketchum, Idaho 83340

(415) 235-3260

dave@sociuscapital.com

Jeff is a co-founder and Managing Director of Socius Capital. He has been President of several small to medium size businesses and has been on the senior executive team of two highly successful IPOs.

Jeff’s functional experience has focused on sales and marketing, primarily to small businesses. As head of strategy, marketing and sales Jeff drove meaningful increases in growth rates at Fleetcor, ADP and Vincam Human Resources.

For example, Jeff took Vincam from $240 million to over $1.2 billion in revenues in just 3 years through investments in sales, marketing and acquisitions. Jeff was also responsible for global marketing execution for the services business at Sun Microsystems and was a strategy consultant with McKinsey & Company.

At Socius Capital, Jeff has served on the board of three portfolio companies that have now been fully exited, OTSP, Wazee Companies and Western Machine Works. Jeff is also personally active as an angel investor. Jeff holds an M.B.A. from Harvard Business School and a B.A. from Northwestern University.

He divides his time between Denver and Vail, Colorado where he enjoys a number of outdoor pursuits, including skiing,

hiking, biking, swimming and golf.

P.O.Box 4124

Avon, CO 81620

(303) 990-7534

jeff@sociuscapital.com

Jeff Lamb

Stephen Hill

Steve is a Managing Director of Socius Capital based in Tampa, FL. For more than 30 years, he has held senior positions in the financial services industry including serving 10 years as President of Eagle Asset Management, a $20 Billion asset management firm. He was also President of Eagle Boston Asset Management and of the Heritage family of mutual funds and was a founder and manager of two hedge fund general partnerships.

He has served as a director or advisor to many private companies including Precision Machine and Manufacturing, Inc., Equitus Corporation and Delta Financial. Steve also currently serves as Chairman of the City of Tampa General Employees’ Pension Fund.

Steve also has experience in the investment banking area at Raymond James where he was responsible for structuring equipment leasing transactions for the firm’sclients and for raising equity for real estate investments. Previously, Steve represented the Southern Company on federal environmental issues and was involved in the licensing of the firm’s nuclear power plants.

Steve holds an engineering degree from Auburn University and received his M.B.A. from Harvard Business School. He has been involved in many community organizations including serving as a Trustee and investment committee member for St. Mary’s Episcopal Day School and as a member of the Alumni Engineering Council at Auburn University. He enjoys many outdoor sports including tennis and golf.

614 West Bay Street

Tampa, Florida 33606

(813) 708-1020 (Office)

(813) 857-2939 (Cell)

steve@sociuscapital.com

Portfolio

For over 90 years, Bell Home Solutions has employed only the finest plumbers, electricians and heating / cooling technicians and remodel experts in Denver. After three generations, the Bell family sold the business and real estate to the existing management team and Socius Capital.

Western provides industrial repair and maintenance services primarily to the pulp and paper, wind energy, marine and hydroelectric sectors. They are the largest independent provider of services to repair or rebuild the rolls used in the manufacture of paper and packaging. Socius Capital, existing senior management and another institutional investor acquired the company from a retired inactive owner.

Pioneer provides recycling processing services throughout the Pacific northwest. Pioneer owns and operates facilities in Tacoma, Washington and Clackamas, Oregon. Socius led the transaction that allowed two highly experienced outside managers to acquire the facilities from a large paper company that no longer considered the assets strategic. Socius Capital’s investment was fully returned through a senior debt raise 3 years after funding. We retain a significant equity position in the company.

Precision manufactures high quality rotary valves, rotary feeders and screw conveyors used in material handling operations throughout North America. The company’s products are designed to be particularly effective in harsh operating environments. Socius acquired the company in concert with existing management from a retiring owner.

Wazee operates a major electric motor and generator sales and service business. They also provide full drivetrain service for turbines serving America’s wind power industry. The transaction can be characterized as a generational transfer, with Socius backing a son in the acquisition of the business from his father. Following considerable organic and acquisition-driven growth, Wazee was acquired by Timken four years after our initial investment.

Intertech is a leading plastics molding manufacturer with a particular emphasis on large tonnage, inefficient-to-ship products. Over its history, the business has developed core competencies in injection molding, blow molding, contract assembly, pad printing, and fulfillment services. Socius Capital’s growth financing was used by the company to purchase additional injection molding equipment to fulfill the needs of a major big box retailer that had consolidated product sourcing to Intertech. Intertech undertook a refinancing to replace Socius with lower cost capital.

Pacific Pharmacy operates independent pharmacies located in medical office buildings and hospital campuses in Southern California. Socius helped facilitate a growth financing that was used to acquire and open new pharmacies.

OTSP is a pioneer in the field of electronic publicity. Socius and existing management worked with an ESOP structure to acquire the company from its two founders.